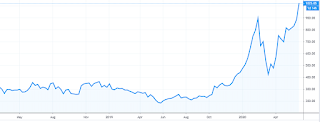

HOW HIGH IS TOO HIGH?

Is Elon Musk himself the chief ingredient in Tesla Motors' trillion-dollar market valuation?

It's true he's been the face of the auto company almost from the beginning. Visionary, but also hypemaster.

HOW MUCH of the current stock price is pure hype?

If the hype is 10%, the stock is overpriced by 10%. If 25%, a 25% overvaluation. And so on.

Tesla fans need to get out of their heads the idea that Tesla is fifteen or twenty times better-- or has a twenty times better future-- than General Motors or Ford. This unrealistic view is based on the most important phrase uttered about Tesla-- whether coined by Musk or one of his team, or one of their fans: "Tesla is more than an auto company."

Is it really?

Maybe at the outset, but legacy manufacturers-- Volkswagen, General Motors, Ford, Hyundai, Mercedes Benz, Toyota-- are scrambling to catch up in tech features, and most importantly, in battery technology.

The Tesla stock price has two props. Two premises. Assumptions which have become assertions.

1.) Tesla will continue to lead in battery efficiency and distance. (Which is, really, the ballgame.)

2.) Tesla will be first to develop Full Self Driving. True autonomous vehicles.

Do these two pillars rest on quicksand?

Re #1. Tesla may have already lost its ten-year lead. Hyundai's Kona Electric has achieved 637 miles per charge. Nio's ET7, 621. The new Lucid Air is getting more than 500. GM's soon-to-appear Ultium battery is said to be state of the art, as is BYD's Blade battery, which will also be used by Toyota.

Re #2. The assumption that Tesla leads in Full Self Driving rests on the assumptions a.) autonomous driving is soon perfectible by anybody; b.) it will be approved for widespread use; c.) consumers in large numbers will buy it. Beyond that is the assumption Tesla, by not using Lidar (a laser imaging device) has chosen the quickest and safest route to the goal. Maybe. But maybe not.

THERE IS also a third pillar sustaining Tesla's stock price, and that's the stock market bubble itself. Once central banks begin seriously raising interest rates in order to quash inflation, what will result? We'll find out.

WHAT IF?

ELON MUSK

COUNTERARGUMENT

THE KEY QUESTION

The key question is: Will Elon Musk's luck run out?